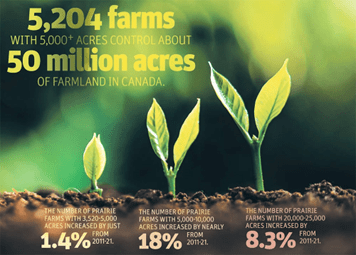

The illustration, taken from the recent Farmland Values Report issued by FCC, doesn’t tell us anything we don’t know in general. Farms are getting bigger. Have been for quite some time now. The Report is interesting to say the least. Trying to put perspective to what’s contained in the Report and then, determining what to do with it requires further information.

Will farms continue to become larger? I think that most people would think so but of course, we don’t know what the future will actually bring. To gain an understanding of the financial implications of the growth in farm size as illustrated above, there is historical financial information that any farm can use in helping to gain perspective on the information in the Report.

Out of curiosity, I looked at the financial data for a real farm for the period 2012 – 2021. The farm fits into the 5,000 – 10,000 acreage category. For the farm I looked at, there wasn’t very much change in its acreage in the ten-year period.

I looked at two financial performance indicators – gross margin efficiency and operating efficiency.

Gross margin efficiency is calculated by subtracting direct productions expenses from gross revenue to arrive at gross margin. And then dividing the gross margin by gross revenue. It indicates how efficient a farm is at utilizing its production expenses (seed, fertilizer, chemical, crop insurance) to generate a margin of profit. A general guideline is 65%, or with gross revenue of $1,000,000 gross margin of $650,000.

EBITDA (earnings before interest, taxes, depreciation/amortization) is a margin of profit before any depreciation or interest costs are included. EBITDA is converted to a ratio when it’s divided by gross revenue. The ratio is called the operating efficiency ratio. It indicates how efficient a farm is at using all its expenses (other than interest and depreciation) in generating gross revenue. A general guideline is 35% or, with gross revenue of $1,000,000 EBITDA of $350,000.

The farm’s financial performance that I looked over the 10 years was significantly variable. Gross revenue per acre ranged from a low of $166 to a high of $385. Gross margin efficiency ranged from a low of 42.4% to a high of 79.2%.

EBITDA ranged from a low of $6 to a high of $215 per acre.

The farm in question had a highly profitable year in 2021. But … for this farm … 2016 was actually even more profitable based on margins and ratios. Operating efficiency in 2016 was 57.7% (compared to 55.6% in 2021).

Is this significant? Not really if you were to look at the EBITDA values. There was less than a $10,000 difference from 2016 to 2021.

What is significant in my opinion is the financial efficiency performance expressed as a function of land values. Farmers capitalize profit. Always have. Likely always will. The value of farmland per acre (based on reported sales in the area in which this farm is located) increased 1.8 times from 2012 to 2016 and then another 2.4 times from 2016 to 2021. Increasing land values are a good outcome if you own land obviously. This particular farm’s net worth increased 1.5 times from 2012 to 2016 and another 1.7 times between 2016 and 2021.

Further, this farm actually had three years with exceptional financial performance. 2016 and 2021 and indicated and also 2020.

When I look at the farm’s performance and factor out those highly profitable years, the performance weakens considerably. Gross margin performance over a seven-year period of 52.3% and operating efficiency at 15.2%.

What does all this mean? It depends on the amount of leverage or debt on the farm. It would be worrisome if the farm was carrying a significant amount of debt.

It also depends on the farm’s appetite for growth, because if the growth comes from increasing the amount of owned land, then there will be an increase in debt.

And it comes back to the reality that farms tend to capitalize profit. As long as financial efficiency margins stay high (resulting in higher profit), then carrying higher levels of debt is not as much of a concern.

But as efficiency margins erode, so do profit margins. Profit margins turn into cash. Eroding margins equals less profit equals less cash for re-investment and for making payments on existing debt. Which is not a pattern any farm wants to end up in.

NASCAR announcers start a race with “Start your Engines”. Certainly, the business of farming is not a race. Having said that though, it would be a good practice to “Watch your Margins”.

If you would like to speak to one of our consultants about this topic, contact us.