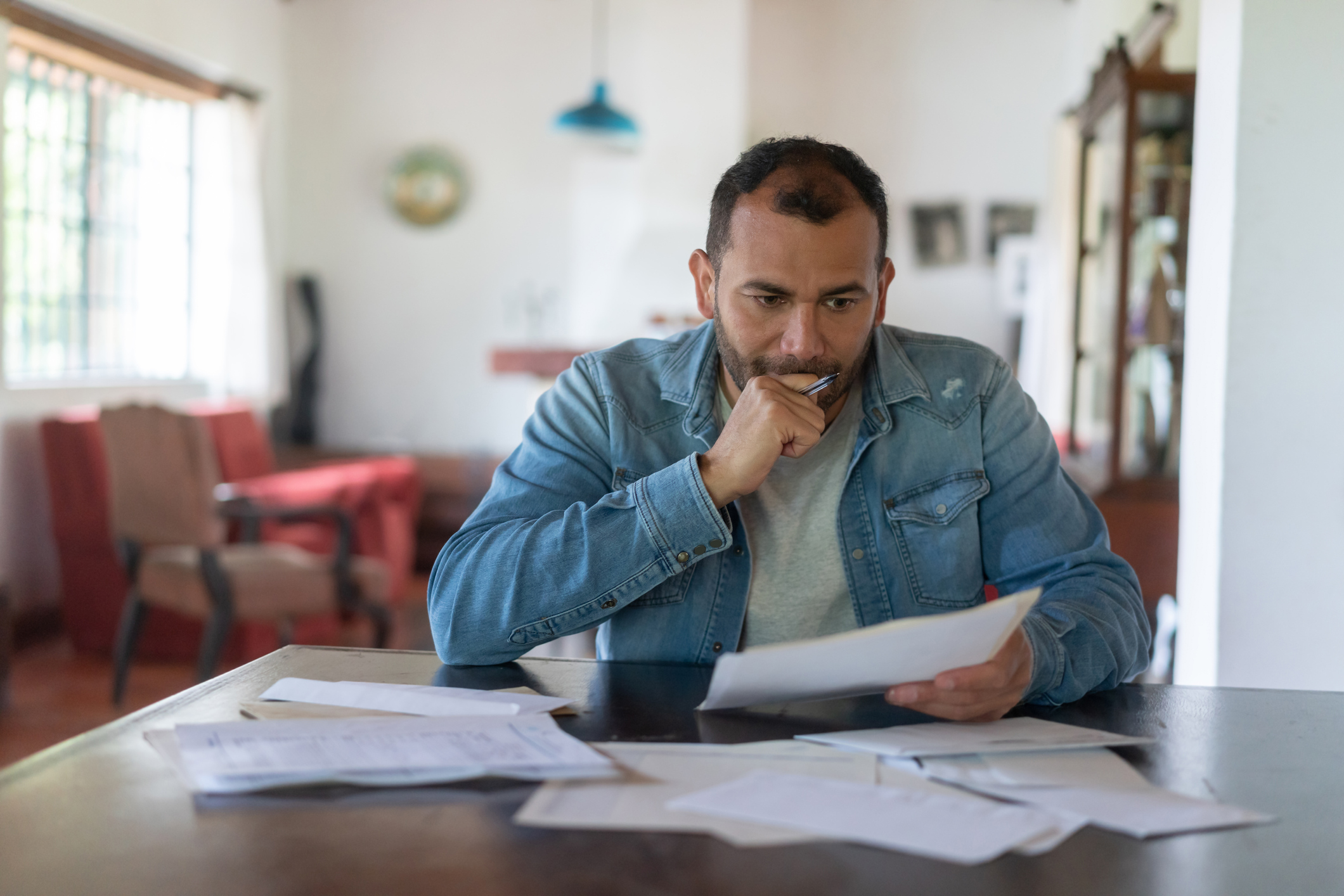

How is it that at the end of each month, the bank account is empty? That’s a question that haunts the great majority of Canadians of all ages. Of course, there can be many reasons.

For individuals and families struggling with this seemingly perpetual reality, it makes sense to look at where the money went. I don’t know this for a fact, but I suspect that people generally don’t take the time to look at this in enough detail to understand what their patterns of cash flow look like.

Without that information, how do they begin to break free of those nasty cash flow challenges? It seems that everything costs a lot these days and inflationary pressures aren’t helping but the problems likely pre-date inflation issues.

Another reason could be where people are “house poor,” with too much of their month-to-month cash flow going to mortgage payments and likely other monthly payments on vehicles, for example. The upward trend in interest rates will make matters worse as interest rate terms mature, exposing people to higher financing costs.

We can apply this discussion to farms, with some adjustments to make it meaningful. A farm’s pattern of cash flow, while transacted monthly, is a function of production cycles — annual for grain and oilseed farms, for example, and monthly for dairy production. Then it is reported annually in financial statements.

Farms will often struggle with cash flow, either monthly at specific times or annually in general. Any challenge with cash flow is not fun and tends to take some of the enjoyment out of farming.

I think a great majority of farms don’t take the time to understand their patterns of cash flow. The more chronic the challenges are, the more important it is to gain an in-depth understanding of where the money is coming from and going to.

For incorporated farms, accountants provide detail on historic cash flow in the statement of cash flows included in the annual financial statement package. It’s good information but summary in nature.

The real benefit from understanding patterns of cash flow is to review past years’ monthly cash flow. Note that unincorporated farms can generate the same information on their cash flow. The review and analysis can be done without having accountant-prepared financial statements.

Farmers can also be “house poor.” We’ve all heard the statement that farmers are asset rich and cash poor. While the “house” we are referencing on a farm can actually be a house, we’re more generally talking about capital investment in land, buildings and equipment.

Too much reinvestment on a farm can easily consume cash flow, especially in the current environment of extremely high capital costs.

What to do about it

Mike Richardson is quoted as saying, “if you don’t like your cash flow in the present, look at your conversations in the past. If you want a certain cash flow in the future, focus on your conversations in the present.”

The conversations he means are the management decision-making conversations. The best form of cash flow comes from operations, from margins of profit. What decisions were made in the past and how did they translate into profit and then cash flow?

First, farmers need to understand how effective past decisions were. Then look at how those decisions can be adjusted now and into the future to create different profit margin and cash flow outcomes.

We all agree that sustained cash surplus is the goal. Let’s define cash surplus.

A cash surplus is the cash that exceeds the cash required to run the operation. This is not the cash that goes to principal repayment on debt or cash used in purchasing capital assets.

How you handle your cash surplus is just as important as management of money into and out of your cash flow cycle. Two of the most common uses of extra cash are paying down debt and investing the cash surplus.

Identifying fixes for cash flow challenges is specific to each farm’s circumstances. The causes of cash flow challenges will often change from year to year.

One thing farmers can do is test their sensitivity to changes in cash flow. Here’s a way to do that:

Surplus operating cash calculation

- Calculate surplus operating cash by subtracting cash operating expenses from cash revenue from farming operations.

Revenue decline ratio

- Divide the cash surplus by total cash operating revenue.

- Convert the value to a percentage.

- This tells you how much your revenue can decrease before your cash surplus is consumed.

Interest rate increase ratio

- Divide the cash surplus by the total outstanding principal or debt.

- Convert the value to a percentage

- This tells you how much interest rates can increase before your cash surplus is consumed.

Expense increase ratio

- Divide the cash surplus by total cash operating expenses.

- Convert the value to a percentage.

- This tells you how much your expenses can increase before your cash surplus is consumed.

If you would like to speak to one of our consultants about this topic contact us.