Advancing Financial Management Competencies

This is a time of year when many farms focus on the financial aspects of their businesses. The focus can be very wide ranging from getting financial statements back from accountants, to preparing information to file tax returns and to providing information to lenders. For a great number of farms, focusing on financial management is not something they look forward to.

However, there are many farms that are genuinely interested in looking at ways in which they can gain a better understanding of their farm’s financial performance and associated strength and weaknesses. I’m going to share some of my thoughts on financial management competencies.

Advancing financial management competencies can be thought of as a step-by-step developmental approach. Do this, then do that for example. But always working toward a greater understanding.

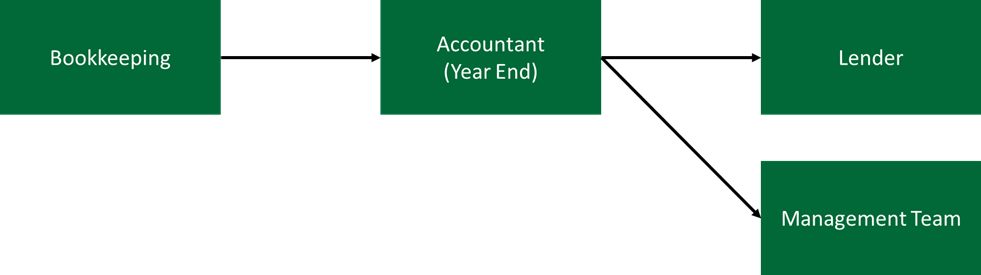

The following image represents a common financial management structure on the farm, where a bookkeeper (either internal or external) records transactions in an accounting software and submits a year-end file to an accountant. The accountant then provides financial statements used by both the Management Team on the farm as well as the lending institution(s).

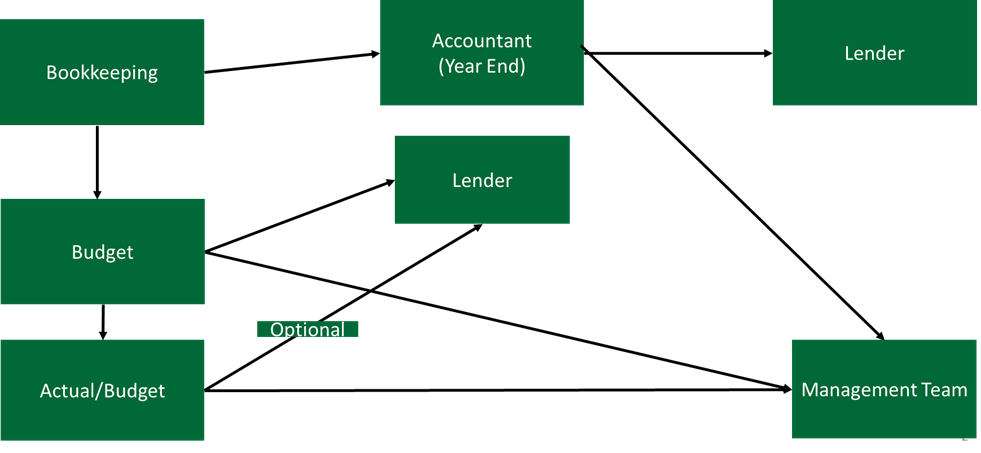

The following image would be the preferred process flow. Financial information is first captured at the bookkeeping function and then used as required to support budgeting, actual-to-budget analysis through the year and for reporting to lenders and the owners/management team.

Comments:

Two questions are foundational to a deeper understanding of financial performance:

-

- How do you use the financial information that you have available to you, to your farm’s best interests?

- What does your financial performance need to look like in the future (a point of time to be defined) to ensure that owners and stakeholders are able to make the required investment decisions at any point in time? In other words, what are you managing towards financially?

Key to the questions above is alignment, alignment within your financial management processes.

Alignment is very important and refers to the financial information being captured at the administrative (bookkeeping) level and used by:

- Accountants for compliance (reporting and tax) requirements.

- Lenders for borrowing and performance review requirements.

- Owners and managers for:

- Performance analysis review; historic and future focused.

- Investment and financing decisions.

- Operational decisions.

If there are gaps within the alignment meaning that different financial information is being used for different purposes by different people, important understanding can literally get lost in translation. The risk is that decisions then aren’t based on good and solid information.

Farm application:

- Review and adjust your existing Chart of Accounts to best enable efficiency and accuracy in aligning bookkeeping functions and related financial management processes as identified above.

- Create processes that you can use to enable quarterly (could be monthly in the future as required) year-to-date financial reports and apply budget-to-actual analysis.

- The purpose is to be able to review your financial performance throughout the year. The objective is to take mid-year performance and through review and analysis, make adjustments where possible to create the best year-end numbers possible. Obviously, once your year is complete, mid-year adjustments are no longer possible and the year’s results are the results.

- The quarterly reports should include balance sheets and income statements so maintaining accurate accounts payable, receivable and especially inventories are essential.

- Establish financial targets and investment guidelines for your farm. This information is used to ‘test’ actual financial performance against a point of time in the future. It helps you to determine if you are making progress and/or if adjustments may be required.

- One-year income statement, balance sheet and cashflow projections need to be developed. These are the budgets against which you will compare progress throughout the year.

- The budget-to-actual analysis referenced above utilizes budget information captured in the projections.

- A rolling 5-year capital budget should be developed.

- Review the most recent year’s financial performance by calculating key ratios. Ideally, 5 years of ratios should be used so that trendlines can be analyzed.

The process outlined above yields information that you can use to gain a better understanding of your farm’s financial strengths and weaknesses.

I understand that there will be other approaches that you could look at for advancing your farm’s financial management competency. The method described above is the framework that we use at Backswath when we work with farm families who are actively wanting to advance their skill sets in financial management.

If you would like to speak to one of our consultants about this topic contact us.